Version in Français (French), Português (Portuguese)

There are many reasons why deeper financial development—the increase in deposits and loans but also their accessibility and improved financial sector efficiency—is good for sustainable growth in sub-Saharan Africa. For one, it helps mobilize savings and to direct funds into productive uses, for example by providing the start-up capital for the next innovative enterprise. This in turn facilitates a more efficient allocation of resources and increases overall productivity.

It also supports the creation of a larger variety of products and services, improves the management of risks, makes payments easier and helps lenders better monitor their clients. In addition, it provides instruments, such as insurance packages, and information that help households and firms to cope with negative events, ensuring more stable consumption and investment.

Given the weakening growth outlook for the region, examining all potential sources or lubricants for growth is now of particular interest. So, in our latest Regional Economic Outlook for Sub-Saharan Africa we examine the extent to which developed, well-functioning and accessible financial institutions and markets could boost growth and what policy options would best help achieve this potential.

Good progress but significant challenges remain

To fully appreciate the potential for further financial development, take a look at the encouraging progress sub-Saharan African countries have made over the last decades.

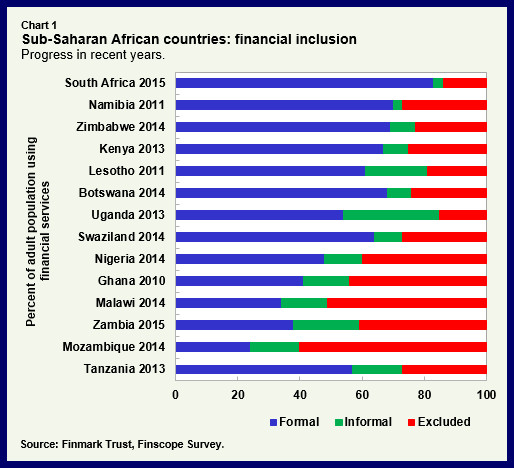

First, the region has led the world in innovative financial services based on mobile telephones, especially in East Africa. The fast spread of systems such as M-Pesa, M-Shwari, and M-Kesho in Kenya has helped reduce transaction costs and facilitate personal transactions even in the absence of traditional financial infrastructure. Microfinance has also grown rapidly, providing services to customers at the lower end of the income distribution, and large parts of the population now have access to financial services more generally (Chart 1).

But financial inclusion, the degree to which all segments of the population can benefit from financial services, still lags well behind that of other developing regions of the world. For instance, as cellphone ownership continues to grow among the poor, the less well educated, and women, there is a large potential to fully exploit mobile payments to compensate for the shortcomings of traditional methods in providing financial services to the most underserved.

Second, the financial sector has deepened—the region’s median ratio of private sector credit to GDP has doubled from its 1995 level. However, with the exception of the region’s middle-income countries, financial market depth and institutional development are also still much lower than in other regions.

Third, we now find Pan-African banks—locally-owned banks that operate in several countries—in the vast majority of sub-Saharan African countries. Their expansion has filled gaps in services left by European and U.S. banks, promoted greater economic integration, and made the sector more competitive. But as often is the case with new and rapidly growing financial developments, Pan-African banks also bring a number of challenges, in particular the need to strengthen supervisory oversight on a consolidated and cross border basis and improve the internal controls and transparency within those institutions.

A large untapped growth potential

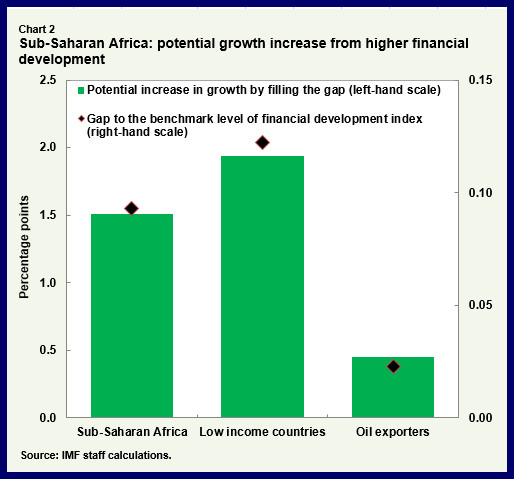

But how much more financial development could sub-Saharan African countries realistically achieve? Examining a combined index of the various dimensions of financial development shows there’s a substantial gap between the level of financial development at which many sub-Saharan African countries are currently operating, and what they could reach when compared to other regions with similar structural characteristics.

So, the potential for further financial development is substantial, and the impact of filling the gap is about 1½ percentage points additional annual growth for the median sub-Saharan African country, with variations across country groups (Chart 2).

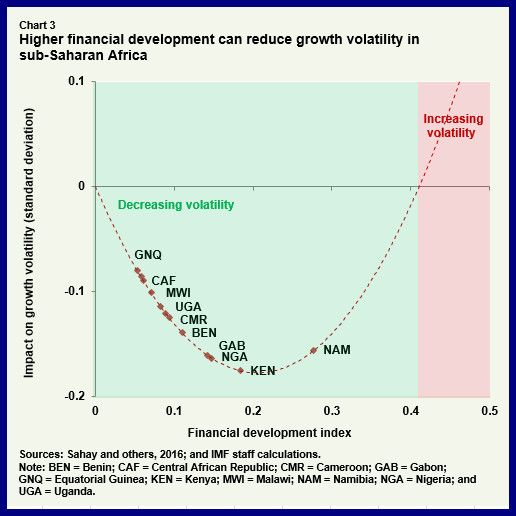

In addition, we show that higher financial development can reduce the volatility of growth, especially if financial development is initially relatively low, as is the case for most countries in the region (Chart 3). Here, more financial development relaxes credit constraints and provides instruments to withstand adverse shocks. However, as the sector deepens, its contribution to reducing volatility declines because financial depth also increases the propagation and amplification of shocks.

Safeguard macro-stability and strengthen institutions stability

So, what should policymakers do to help sub-Saharan African economies reap this potential?

Our analysis shows that the region’s financial development has been largely driven by better macroeconomic fundamentals over the last decades, but hindered by weak institutions. So, providing strong legal and institutional frameworks and corporate governance in particular, are critical for creating an environment in which the financial sector can develop and thrive.

But countries also need to be vigilant about risks to the financial system and their spillovers to the economy. As regulations in many countries are not fully in line with global best practices, and their implementation remains weak, improving the regulatory framework and strengthening supervisory capacity as well as enforcement powers are essential. Among many other reforms, the harmonization of regulations and supervisory procedures to avoid regulatory arbitrage and establishing an appropriate mechanism for resolving nonviable financial institutions are high priorities.

Finally, financial supervisors should monitor carefully the risk related to mobile money transactions as they become increasingly popular in the low-income segment of the population—ensuring households’ funds are safe while allowing them to enjoy making transactions more easily, saving for worse times or taking up a loan to start a business.